How does Oglethorpe determine your financial need?

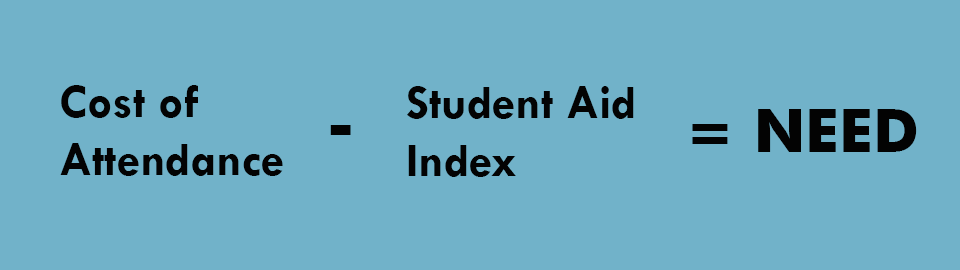

What the heck is financial need? What does that even mean? Financial need is the difference between what it costs to go to Oglethorpe and what you are expected to contribute (read: pay).

Excellent question! The cost of attendance includes your tuition, lab fees if any, activity fee, and room & board. The cost of attendance also accounts for some expenses that are not fees paid to the university. For example, your school books, transportation costs, etc. Side note, the cost of attendance can vary greatly depending on whether or not you live on campus and then which dorm you will be living in. For determining need, we use the same COA for everyone, which is determined using rules established by law.

Alright, so we understand that the cost of attendance includes tuition, room & board, activity fee, etc. and that it will vary depending on where we live.

- Students from Georgia, living on-campus: $67,158

- Students from out of state: $68,108

- Students living off-campus in an apartment: $68,588

- Students commuting from their parents’ home: $56,828

You won’t know where you are living until the summer before you enroll at Oglethorpe but will want a financial aid package earlier in the year for the purposes of making a decision, we use the same cost of attendance estimate which includes living on campus in our Traer Residence Hall as it is our largest freshman residence hall. Note that for Adult Degree Program (ADP) students, the cost of attendance will vary from these.

A Student Aid Index or SAI is a number produced by your completed FAFSA that’s used to help colleges determine your financial need.

The FAFSA is the Free Application for Federal Student Aid. It’s basically an application to get financial assistance from the federal government for your schooling. Learn more about it on our FAFSA page.

It is determined by a combination of a government formula called the “Federal methodology”, which is based on information provided in your FAFSA (family size, number in college, income, and assets). There’s no person sitting inside a windowless office crunching numbers. This allows us to determine both the federal aid you qualify for as well as the amount of Oglethorpe aid you may receive. The SAI is made up of two parts: the student contribution and the parent contribution.

The student contribution to the SAI is determined by taking a percentage of your income and assets.

The parent contribution is calculated by a percentage of the total income and assets, AFTER allowances.

Total income is the amount of money your family earns…both the taxed and untaxed income. From that number the Federal government deducts three allowances.

- Income Protection Allowance: which takes into consideration where you live in determining basic expenses.

- Employment Allowance: which accounts for the costs of working.

- Asset Protection Allowance: which takes your parents’ ages into account, protecting more of your assets as you get closer to retirement.

What’s left after allowances is considered discretionary income and parents are expected to pay a percentage of that for your school.